Make 1099-S Filing Part of Your Real Estate Closing Process

Updated: December 2021

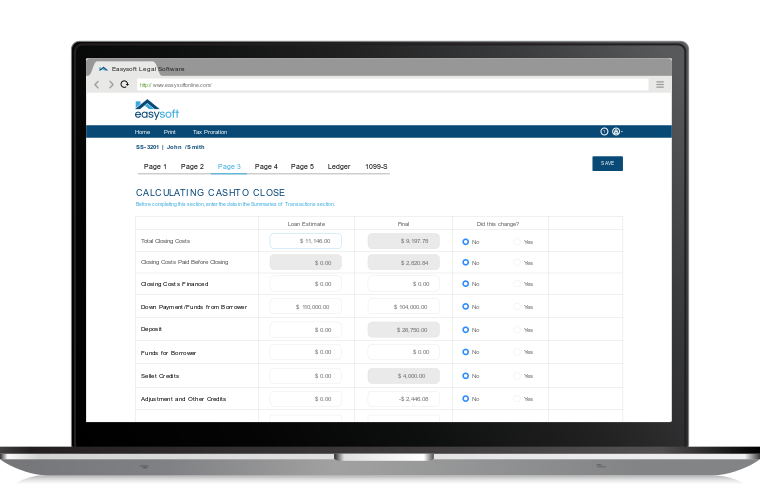

There is a tremendous amount of paperwork associated with real estate sale closings and attorneys and legal professionals have to be careful not to forget anything. Although Easysoft Legal Software’s Real Estate Closing Software helps with the HUD-1 settlement statement, it also can streamline other tasks like filing your 1099-S forms electronically.

What Is The 1099-S?

Form 1099-S is subtitled “Proceeds From Real Estate Transactions” so it's pretty self-explanatory. It serves to report the sale or exchange of real estate property. Any time you sell or exchange a property this form must be filed with the IRS and a copy sent to the seller. The form must be filed with the IRS by February 28 of the year following the sale (or March 31 of the following year if e-filed), and a copy must be sent to the seller by January 31 of the following year. You must keep a copy of the form for four years. There are some exceptions and qualifications to this basic rule, but the vast majority of real estate transactions will require the closing attorney to file this form. Failure to file will incur fines from the IRS.

Filing Forms Manually

Although the 1099-S is not a difficult form, nobody likes dealing with taxes so many real estate professionals put the filing off until the last minute. In January of every year, you will find far too many organizations rushing to fill out the 1099-S forms on all the transactions they executed over the last year, pulling out stacks of files to find the necessary information.

Filling out the 1099-S by hand is tedious, time consuming, and leaves room for error. Again, it's not hard, just monotonous. It's also very easy to make simple mistakes while copying information from your records, mistakes that will come back to haunt you and your clients later. When you save all your filing for the end of the year, it becomes even more cumbersome and the odds of making mistakes can increase. Luckily there is a better way.

Filing Forms Electronically

Easysoft Real Estate Closing Software includes an e-filing option for 1099-S forms which makes it easy to adjust the workflow of your firm to file as you close and not wait until the end of the year. With a click of the mouse, you get a complete 1099-S form that is automatically populated with data from your HUD form. This means no transcription errors and much faster form generation.

What's even better is you can e-file your 1099-S from right inside Easysoft with the click of a button. For a nominal fee, our InfoTrack integration will handle to the IRS requirements and send a copy to the seller. You instantly get confirmation number so you know the forms have been sent, and our closing software keeps a log of submitted documents for future reference and reporting. You save time and eliminate the risk of late filing fees. Filing is simple and it can easily become part of your closing process, so you no longer have to deal with dreaded stacks of forms to fill out at the end of the year.

But what if this sale or transfer is a primary residence that is exempt from 1099-S filing requirements? No problem. Easysoft Legal Software can also print out a 1099-S exemption form. Keeping this on file will satisfy the IRS re4quirement to have written assurance that exemptions requirements have been met.

Nobody wants to mess with the IRS. With Easysoft Closing Software you get HUD settlement statement software plus 1099-S e-filing -- what more do you need?

Easysoft Legal Software is the ultimate 1099-S integrated closing software for real estate legal professionals that give them the ability to keep 1099-S forms from piling up. See for yourself how easy, fast, and helpful the e-filing feature is when you schedule a demo and begin using it with your FREE 7-day trial.

Easysoft - the power you need at a price you can afford.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.