Easy HUD Is A Great Tool For Refinances As Well

We talk often about how Easy HUD speeds up the closing process on the purchase and sale of properties, but it is also a valuable tool when helping a client to refinance a home. This is not just HUD-1 software; it is also HUD-1A software.

How Refinances Differ

The HUD-1A is an optional form that can be used whenever a real estate transaction doesn't have a seller. The most common situation is a mortgage refinance, though there are a few other transactions that would fall under the HUD-1A as well. The HUD-1A is similar to the HUD-1 settlement form but is shorter. There is no seller information. Sections J and K (Borrower's and Seller's Transactions respectively) -- basically the contents of the first page -- are not on the HUD-1A form.

Although many HUD-1 information sections are missing, there is also a new section: Section M, Disbursements to Others. This is where you list anyone other than the borrower who received a portion of the loan. For example in a refinance you would list the original lender, since that loan will be paid off. In a loan consolidation, list any creditors paid with the borrowed funds.

How Refinances Are The Same

The heart of the HUD-1A is Section L, Settlement Charges. This looks pretty much exactly the same as the HUD-1 form. You will also need to complete the GFE-HUD comparison sheet to ensure that final charges are within the Good Faith Estimate limits allowed.

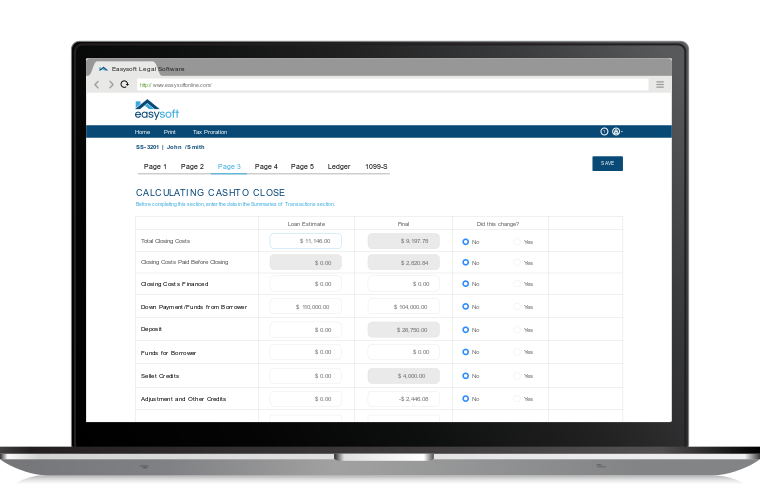

From an Easy HUD point of view, you get other similarities. You get the advantage of having all client information in a central database. If you used Easy HUD for the original sale, you can pull the client information for the HUD-1A. Correspondence and other documents generated with Easy HUD will pick up this data as well so information is consistent across documents. You get automated calculations, simple HUD form generation and faster closing on a refinances, just as you do on a property purchase or sale.

Should You Use The HUD-1A?

The HUD-1A is an optional form, unlike the HUD-1. The HUD-1 can substitute for the HUD-1A if you use the buyer's side of the form, but since Easy HUD provides both forms there probably isn't any reason to do so. Note the reverse substitution is not allowed; the HUD-1A cannot be used in any transaction where the title changes hands.

Many lenders use the HUD-1A in cases of home equity lines of credit. This is not required but might be a good option, since it provides a strong audit trail. In financial transactions, more documentation is usually better than less. Easy HUD makes it so easy to complete the form that you should consider using it even when it is not required by HUD regulations.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.