VA Loan Guidance

VA Loan Guidance – New Documentation Requirements for Lenders

The 2010 RESPA rule changed residential loan closing requirements and, in response, the Department of Veterans Affairs (VA) issued The VA Circular 26-10-01, effective May 1, 2010. The circular:

- Sets caps on fees and charges veterans may pay when obtaining a VA-guaranteed home loan.

- Provides new documentation requirements for lenders.

- Eliminates a previously required disclosure statement loan origination fee disclosure.

The 2010 RESPA Rule compliant HUD-1 no longer has a separate line called “Loan Origination Fee” to record the lender’s origination fee. Instead, Line 801 (“Our Origination Charge”) on the HUD settlement statement is used to record combination of the origination fee and the previously itemized fees.

Since VA will continue to have a cap on the origination fee and limits the types of charges the veteran may pay, lenders must itemize the fees included in the “Our Origination Charge” line on the HUD-1 Settlement Statement.

VA Instructions for Lenders

According to the VA Circular, lenders issuing VA loans may disclose the fees in one of two ways:

- Lenders may itemize the charges in the empty 800 lines of the HUD-1 to the left of the column. If there is not sufficient space to itemize all of these fees on the HUD-1, lenders must provide a separate origination statement, the format of which is specified in the Circular.

- The new origination statement must indicate the purpose of the charge and the amount (i.e. Origination Fee – $1,000 and MERS Fee- $15.00). The borrower must sign and date the new origination statement.

While the new VA loan origination statement is a lender document, according to Circular 26-10-01, at Easysoft Legal Software, we see many lenders requiring settlement agents to prepare it!

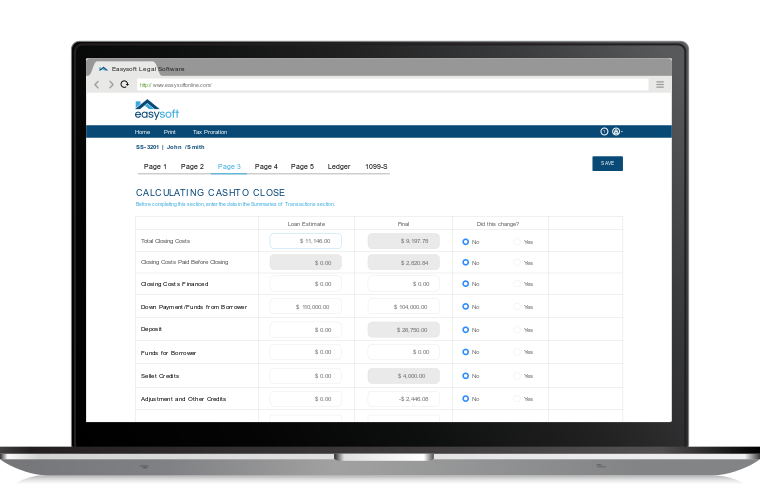

Easysoft Legal Software’s HUD Software to the Rescue

In the Easy HUD, HUD software program, settlement agents will find a built in solution to fulfill the VA loan origination fee requirement, if the lender expects them to prepare the VA loan origination statement.

Easy HUD Smart Itemization feature tracks itemized charges for many lines such as 801, 802, 1101, 1102, 1104, 1107-1109, etc. With Smart Itemization, you can enter itemized charges and prepare a separate statement; and record consolidated charges on the HUD settlement statement. And that’s not all, with a Line 801 Smart Itemization; a separate “Print VA Itemization” button is available in the program, which will produce the necessary Origination Statement for a VA loan closing.

VA Circular 26-10-01, dated Jan 7, 2010.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.