Easysoft Legal Software Blog

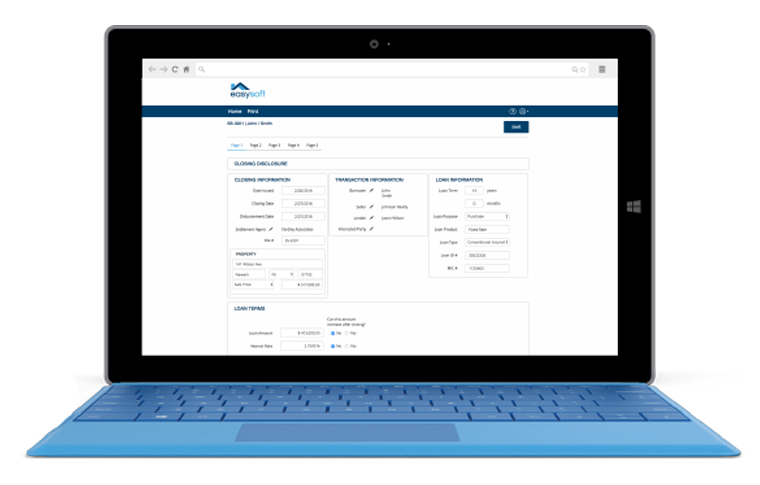

Real Estate Settlement Software and TRID Compliance

Reasons Why EasySoft is the Best Real Estate Closing Software for Attorney

CIS and Child Support Worksheets

By The Numbers: Accurate Ledgers are Key for Real Estate Firms

Easysoft’s real estate software ledger module…

Closing Disclosure Software for Georgia Attorneys

Legal Software Programs for Alabama Real Estate Attorneys

5 Critical Tools in Real Estate Closing Software for your Practice

Lawyer’s Guide to Starting a Real Estate Law Practice

Massachusetts vs. Family Law Software: Which Software Works Best for Matrimonial Attorneys?

How New York Real Estate Attorneys Can Benefit from Maintaining Relationships with Banks

Adding Family Law to Your General Practice in Massachusetts

Specialized Software for NJ Family Law Professionals who use Mac Computers

Qualia vs Easysoft: Software Comparison for Real Estate Attorneys and Paralegals

Why You Need Closing Disclosure and HUD Forms

Easysoft, SoftPro, or RamQuest: Which One Do You Need In Your Office?

There is no shortage of real estate closing software systems on the market today. Real estate attorneys and settlement agents have their choice of systems and solutions that make the closing process easier, streamline procedures, and maintain compliance... Read more >

Avoid 1099-S Overwhelm During Tax Season with Software

Real estate lawyers know how time-consuming paperwork is. Especially when it comes time to submit tax filing paperwork this time of year. Whether you are a solo practitioner or have a small office with staff, getting all of your clients’ 1099-S forms together at tax time can seem like a daunting task... Read more >

Easysoft Family – New Jersey vs. Family Law Software

When it comes to specialized software for New Jersey family law practices, it can be a challenge to find the RIGHT solution for your needs. When getting started, it is important to remember that not all software solutions are created equal and every firm is unique in its needs, that’s why asking questions before you buy is important... Read more >