TILA RESPA Integrated Disclosure (TRID) Resources

TILA RESPA Integrated Disclosure (TRID) in real estate is a necessary step in closing on a home. The TRID forms need to be completed accurately and in a timely manner. TRID software can help real estate professionals by automating these forms. With TRID software, you can save time, be efficient, and ensure accuracy.

A Brief History of TRID in Real Estate

The TILA-RESPA Integrated Disclosure (TRID) rule is a consolidation of the four existing disclosure forms previously required under TILA and RESPA separately. For more than 30 years, consumers had to complete two different sets of disclosure forms when applying for a loan and shortly before closing the loan.

Two different Federal entities developed forms separately under TILA and RESPA. The information on these forms overlapped, and there were inconsistencies in the language of each. Consumers would regularly find the forms confusing. Additionally, lenders and settlement agencies found the forms to be demanding to explain and provide.

As a result of the Dodd-Frank Act , the Consumer Finance Protection Bureau (CFPB) was created. Their task was to integrate the mortgage loan disclosures that existed separately under the Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act of 1974 (RESPA).

On October 3, 2015, the Know Before you Owe mortgage rule was implemented and replaced the existing forms with two new forms, the Loan Estimate, provided three business days after the application for a loan is submitted, and the Closing Disclosure, provided three days prior to closing.

This new rule is called The TILA-RESPA Integrated Disclosure rule or TRID. TRID was put in place to solve the following issues:

- Insufficient time to review documents: Often, paperwork is not able to be reviewed until the day of the closing. There is an overwhelming amount of pressure to provide a signature on multiple parts of the forms, and the consumer may not have enough time or patience to understand what is being signed.

- Too many forms: Coupled with the short amount of time to review the documents is the sheer amount of documents that need to be provided. This could make the process of closing overwhelming and daunting, and consumers often feel as though they may have made a long-term impact on their financial well-being by neglecting to review all documents presented to them.

- Documents are written in a manner that is difficult for consumers to understand: There is a lot of technical jargon and legal terms that only the lender or settlement agent would be able to decipher, possibly at additional costs.

- Documents are prone to errors: Ranging from misspelled names to forgetting your spouse’s name on the documents, any error would result in the entire set of documents needing to be completed again.

The Results

After the integration of the forms was proposed, the CFPB conducted a validation study with 858 consumers.

The conclusion was that the new integrated forms' average performance was statistically significant over the current disclosures. In addition to new integrated disclosures, the final rule provides detailed explanations of how the forms are to be completed and used.

The Loan Estimate Form and the Closing Disclosure Form

TRID regulation resulted in the creation of two forms: the Loan Estimate Form and the Closing Disclosure Form.

The Loan Estimate form provides consumers applying for a mortgage with a thorough understanding of the features, costs, and risks. This form is provided to consumers within three business days after a loan application is submitted.

The purpose of the Closing Disclosure form is to give consumers an understanding of all of the associated costs of the transaction. This form is to be provided to consumers three business days before the loan is closed.

Some improvements the new forms have over the previous versions available include clearer language and a better design for consumers to locate key information: interest rates, monthly payments, and costs to close the loan.

Consumers can now also be provided information to help them decide if the loan is affordable and compare other loan offers, which also provides the cost of the loans over time. To reduce the burden on lenders and others assisting with the completion of the forms, detailed instructions are now being provided for each of the new forms.

These instructional TRID rules include:

- Entering information in comprehensive case data sections or directly on HUD-1, HUD-1A settlement statements. The HUD form software performs all calculations and completes closing documents automatically.

- Language designed to assist consumers’ understanding of complex mortgage and real estate transactions.

- Prioritizing the information deemed most important to consumers, specifically, the interest rate, monthly payments, and the total closing costs. These will all be prominent on the first page.

- Information about the costs involved with the mortgage loan and if there will be any changes in the future. If there are any changes to the costs of taxes, insurance, interest rate, or payments, this will allow the consumer to make an informed decision on whether they can afford the loan and mortgage now and going forward.

- Preparing borrowers about features they may want to avoid, such as an increase to the mortgage loan balance when payments are on time or penalties for paying off the loan early.

- Increasing the reliability of cost estimates the consumer receives for services needed to close a margin loan, such as appraisal or pest inspection fees. The rule dictates that any increase in charges from lenders, their affiliates, and for services that the lender does not permit the consumer to shop unless an exception applies, is prohibited.

Home equity lines of credit, reverse mortgages, and mortgages secured by a mobile home or by a dwelling not attached to real property (land) are not covered by the TRID laws.

The rule does not apply to a creditor who makes five or fewer mortgages per year. The final rule applies to most closed-end consumer mortgages. Easysoft has implemented these changes in its real estate closing software. To qualify for a 7-day trial, click here.

History of Integration Efforts

For more than 30 years, TILA and RESPA have required lenders and settlement agents to provide borrowers who apply for a mortgage loan with different, but overlapping disclosure forms regarding the terms of the loan and its costs.

Throughout this time period, the duplicitous nature of the forms was identified as being inefficient and confusing for both the consumer and the industry that they were borrowing from.

There have been previous efforts to integrate the TILA and RESPA disclosure forms, inspired by the complexity, amount, and overlap of information in the forms.

Congress enacted the Economic Growth and Regulatory Paperwork Reduction Act of 1996 which required the board and HUD to “simplify and improve the disclosures applicable to the transactions under TILA and RESPA, including the timing of the disclosures, and to provide a single format for such disclosures which will satisfy the requirements of each such Act with respect to such transactions.”

If the agencies found that legislation was necessary or appropriate to simplify the disclosures, a report was to be submitted to Congress with recommendations. The Board and HUD did NOT propose an integrated disclosure but did submit a report that concluded that “meaningful change could come only through legislation” and provided their recommended revisions for TILA and RESPA.

The agencies made recommendations to amendments both to TILA and RESPA in their report. These included a clearer definition of finance charge, and replace the “some fees in, some fees out” approach with “all costs the consumer is required to pay in order to close the loan, with limited exceptions.” The report did not result in legislative action.

In 2009, the Board published the 2009 Closed-End proposal, which included sweeping changes to the TILA disclosures and stated the Board would continue to work with HUD toward an integration of the two disclosure form system.

The proposal also stated that consumer insight would be used to better tailor the forms for mortgage loan purposes. Ten months later, in July 2010, the Dodd-Frank Act was enacted by Congress, transferring authority under TILA and RESPA to the Bureau and that the Bureau would write a singular disclosure scheme for both the opening and closing of a loan.

To access the new features of our real estate closing software, click here.

Two new forms created by TILA-RESPA

Loan Estimate Form

Replaces two current Federal Forms.

- Good Faith Estimate designed by HUD under RESPA

- Truth in Lending Disclosure designed by Board of Governors of the Federal Reserve Board under TILA

- New form also incorporates new disclosures required by Congress

- Provision by Mortgage Broker: loan estimate form is to be provided to consumer upon receipt of an application by a mortgage broker

- Timing: Lender provides consumer form no later than three business days after the consumer applies for a mortgage loan

- Limitation on Fees: Consumer cannot be charged fees until the consumer has received the Loan Estimate form AND have communicated their intent to proceed with the transaction

- Disclaimer on Early Estimates: Estimates can be provided to consumers prior to the application but must contain a disclaimer to prevent confusion with the Loan Estimate form

Learn more about the Loan Estimate Form .

Closing Disclosure Form

Replaces two current Federal Forms

- The HUD-1 form, designed by HUD under RESPA

- Truth in Lending disclosure designed by the board under TILA

- New form also incorporates new disclosures required by Congress

- Timing: Consumers must be provided the Closing Disclosure form at least three business days before the consumer closes a loan.

If significant changes are made between the delivery of the form and the closing, such as changes to the APR above 1/8 a percent, changes to the loan, or a prepayment penalty has been added, the consumer must be given a new form with an additional three business day waiting period after the new form is received.

Provision of Disclosures: The creditor is responsible for delivering the CDF to the consumer. Settlement agents may also provide the form, as long as they comply with the requirements.

The final rule acknowledges the settlement agents' role in the closing of real estate and mortgage loan transactions in addition to their preparation of HUD-1. Any uncertainty regarding the role of settlement agents is avoided, and there is sufficient flexibility for creditors and settlement agents in deciding the most efficient means of delivery of the CDF to consumers.

In addition to the features you already may be familiar with from Easysoft’s HUD form feature, including automatic tax calculation and one-click electronic 1099-S filing, discover other ways Easysoft’s settlement software will improve your real estate closing business.

TRID Compliant Closing Disclosure Forms for 2015

Download these resources from the CFPB to familiarize yourself with the new law changes.

- Final Rule for Integrated Mortgage Disclosures : The entire rule outlining the reason the forms are being replaced and the ramifications of the new forms.

- Guide to the Loan Estimate and Closing Disclosure : A thorough guide to the two new forms, the Loan Estimate and Closing Disclosure form.

- Small Entity Compliance Guide : This guide highlights issues that small creditors, and those that work with them, might find helpful to consider when implementing the new rule. This is meant to help small entities comply with the new regulations.

- Loan Estimate : An example of a completed Loan Estimate form.

- Closing Disclosure : An example of a completed Closing Disclosure form.

- Models and Samples of Completed Forms : Samples of short form disclosures for various account types

- Factsheet for Integrated Mortgage Disclosures : Provides helpful information about the new “Know Before You Owe” forms.

- FPB Testing Process : Details surrounding the examination procedures for regulated entities and to ensure that there are no violations of Federal consumer financial law

- TILA RESPA Integration Disclosure Timeline Example : General information along with a calendar showing the process and timing of disclosure for an example real estate purchase transaction under the TILA RESPA Integrated Disclosure rule.

TILA RESPA Implementation Challenges

Because of the impact the implantation of TILA RESPA will have, there are some outstanding issues. For instance, some lawmakers are asking for a “hold harmless” period.

On October 7, 2015, the U.S. House of Representatives passed a bill that would provide such a grace period for five months, through February 1, 2016, for good-faith efforts to comply with the new TRID changes. The bill now faces the Senate, where its future remains uncertain.

Below are links to related news stories related to TILA RESPA:

- CFPB Disclosure Regime Could Force Smaller Lenders Out of Business 4.14.2015

- Most lenders are still unprepared for TRID 4.14.2015

- Senate Banking Committee to hold April 16 hearing on mortgage credit availability 4.14.2015

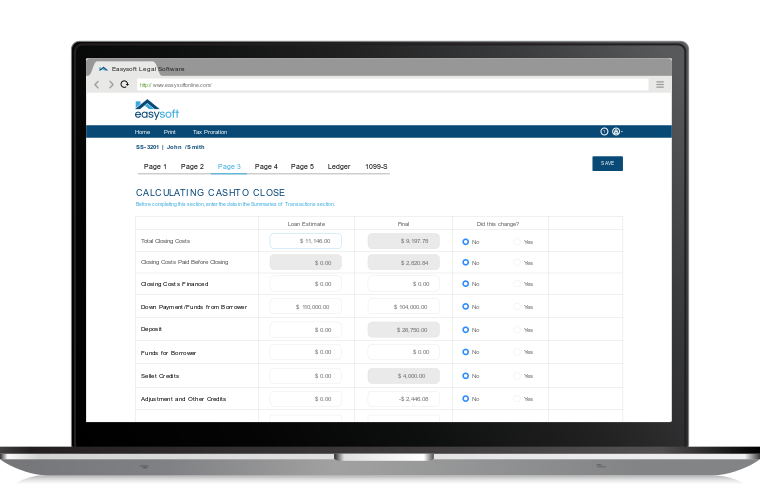

TRID Compliance Software

While you should be aware and informed of TRID regulations, TRID resources like TRID compliance software can help ensure you are filling out the forms accurately and efficiently. At Easysoft, we help real estate professionals like yourself remain compliant through form automation.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.